1

General Discussion / Re: Pemain karatan agen judi game slot online - new post from 3w, game pragmatic slot android &amp

« on: August 07, 2023, 05:11:25 AM »

A trader who nailed the end of Bitcoin’s (BTC) 2021 bull market is outlining when the crypto king could witness a big burst to the upside.

Pseudonymous analyst Pentoshi tells his 699,400 Twitter followers that capital appears to be leaving the crypto markets.

However, the trader says that market conditions will likely change in the coming months just before Bitcoin witnesses its next halving event.

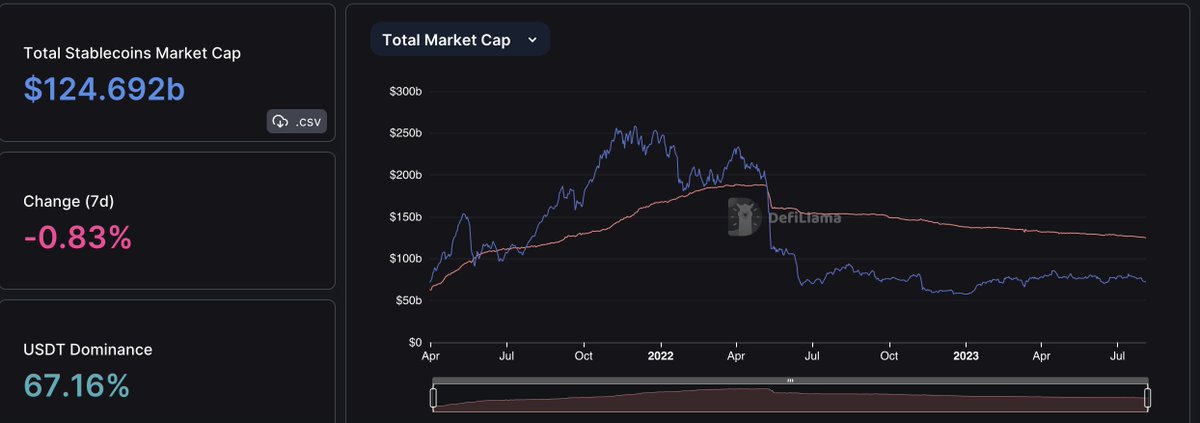

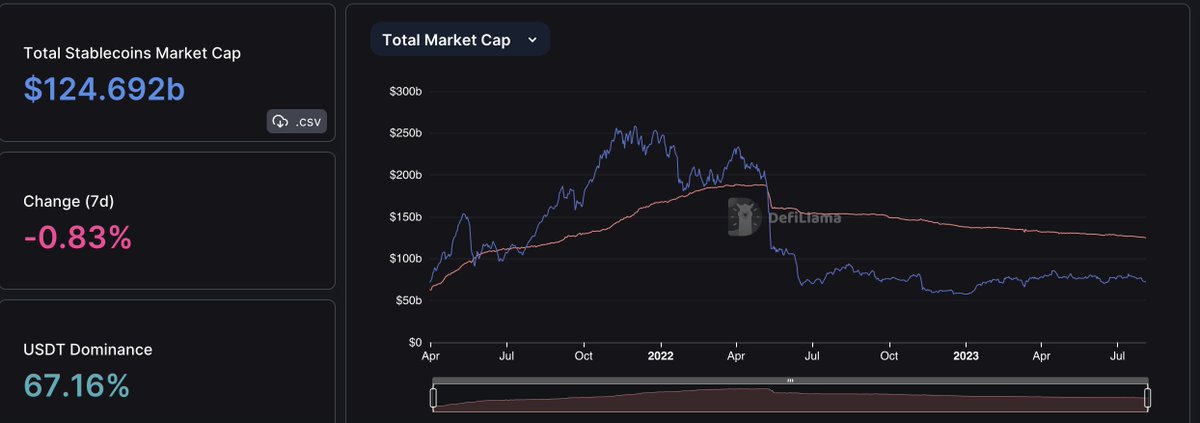

“Every day checking stablecoin (market cap) and total value locked (TVL).

Every day, stablecoin (market cap) goes down, TVL goes down, *MOST* altcoins TREND down.

When new money? SOON! Think by or around Q1 2024 BTC is screaming up…

Hate to think where we’d be if it wasn’t for Saylor, Tether + ETF (exchange-traded fund). Maybe sub $20,000.”

Source: Pentoshi/Twitter

The next Bitcoin halving is slated for April 2024.

In the meantime, the trader holds a bearish outlook on BTC due to two macro headwinds.

Pentoshi says that the recent rally in the oil markets suggests that inflation will once again rear its ugly head. He also expects regulators to hold off on approving a spot-based Bitcoin exchange-traded fund (ETF).

According to Pentoshi, the ensuing correction from these two factors could set up BTC for a huge rally once regulators green light a Bitcoin ETF.

“Maybe after ETF Delay + Hot CPI (consumer price index) print. Fake dump into pump seems likely for later ETF spot approval…

Has nothing to do with hope. Everything to do with paying attention (my job).

Have you looked at energy in the last six weeks? Oil is up 24%, which leads to everything going up. Will either see it this (CPI) print or next. Fed is now showing a hot print as well.”

At time of writing, BTC is worth $29,098.

Source: dailyhodl

Cryptocurrency exchanges review:

#1 OKX - 24h Volume: $ 1 097 255 972.

OKX is an Hong Kong-based company founded in 2017 by Star Xu. Not available to users in the United States.

#2 ByBit - 24h Volume: $953 436 658.

It is headquartered in Singapore and has offices in Hong Kong and Taiwan. Bybit works in over 200 countries across the globe with the exception of the US.

#3 Gate.io - 24h Volume: $ 643 886 488.

The company was founded in 2013. Headquartered in South Korea. Gate.io is not available in the United States.

#4 MEXC - 24h Volume: $ 543 633 048.

MEXC was founded in 2018 and gained popularity in its hometown of Singapore. US residents have access to the MEXC exchange.

#5 KuCoin - 24h Volume: $ 513 654 331.

KuCoin operated by the Hong Kong company. Kucoin is not licensed to operate in the US.

#6 Huobi - 24h Volume: $ 358 727 945.

Huobi Global was founded in 2013 in Beijing. Headquartered in Singapore. Citizens cannot use Huobi in the US.

#7 Bitfinix - 24h Volume: $ 77 428 432.

Bitfinex is located in Taipei, T'ai-pei, Taiwan. Bitfinex is not currently available to U.S. citizens or residents.

My bitcoin-blog: https://sites.google.com/view/my-crypto-jam/portfolio

=)

Pseudonymous analyst Pentoshi tells his 699,400 Twitter followers that capital appears to be leaving the crypto markets.

However, the trader says that market conditions will likely change in the coming months just before Bitcoin witnesses its next halving event.

“Every day checking stablecoin (market cap) and total value locked (TVL).

Every day, stablecoin (market cap) goes down, TVL goes down, *MOST* altcoins TREND down.

When new money? SOON! Think by or around Q1 2024 BTC is screaming up…

Hate to think where we’d be if it wasn’t for Saylor, Tether + ETF (exchange-traded fund). Maybe sub $20,000.”

Source: Pentoshi/Twitter

The next Bitcoin halving is slated for April 2024.

In the meantime, the trader holds a bearish outlook on BTC due to two macro headwinds.

Pentoshi says that the recent rally in the oil markets suggests that inflation will once again rear its ugly head. He also expects regulators to hold off on approving a spot-based Bitcoin exchange-traded fund (ETF).

According to Pentoshi, the ensuing correction from these two factors could set up BTC for a huge rally once regulators green light a Bitcoin ETF.

“Maybe after ETF Delay + Hot CPI (consumer price index) print. Fake dump into pump seems likely for later ETF spot approval…

Has nothing to do with hope. Everything to do with paying attention (my job).

Have you looked at energy in the last six weeks? Oil is up 24%, which leads to everything going up. Will either see it this (CPI) print or next. Fed is now showing a hot print as well.”

At time of writing, BTC is worth $29,098.

Source: dailyhodl

Cryptocurrency exchanges review:

#1 OKX - 24h Volume: $ 1 097 255 972.

OKX is an Hong Kong-based company founded in 2017 by Star Xu. Not available to users in the United States.

#2 ByBit - 24h Volume: $953 436 658.

It is headquartered in Singapore and has offices in Hong Kong and Taiwan. Bybit works in over 200 countries across the globe with the exception of the US.

#3 Gate.io - 24h Volume: $ 643 886 488.

The company was founded in 2013. Headquartered in South Korea. Gate.io is not available in the United States.

#4 MEXC - 24h Volume: $ 543 633 048.

MEXC was founded in 2018 and gained popularity in its hometown of Singapore. US residents have access to the MEXC exchange.

#5 KuCoin - 24h Volume: $ 513 654 331.

KuCoin operated by the Hong Kong company. Kucoin is not licensed to operate in the US.

#6 Huobi - 24h Volume: $ 358 727 945.

Huobi Global was founded in 2013 in Beijing. Headquartered in Singapore. Citizens cannot use Huobi in the US.

#7 Bitfinix - 24h Volume: $ 77 428 432.

Bitfinex is located in Taipei, T'ai-pei, Taiwan. Bitfinex is not currently available to U.S. citizens or residents.

My bitcoin-blog: https://sites.google.com/view/my-crypto-jam/portfolio

=)