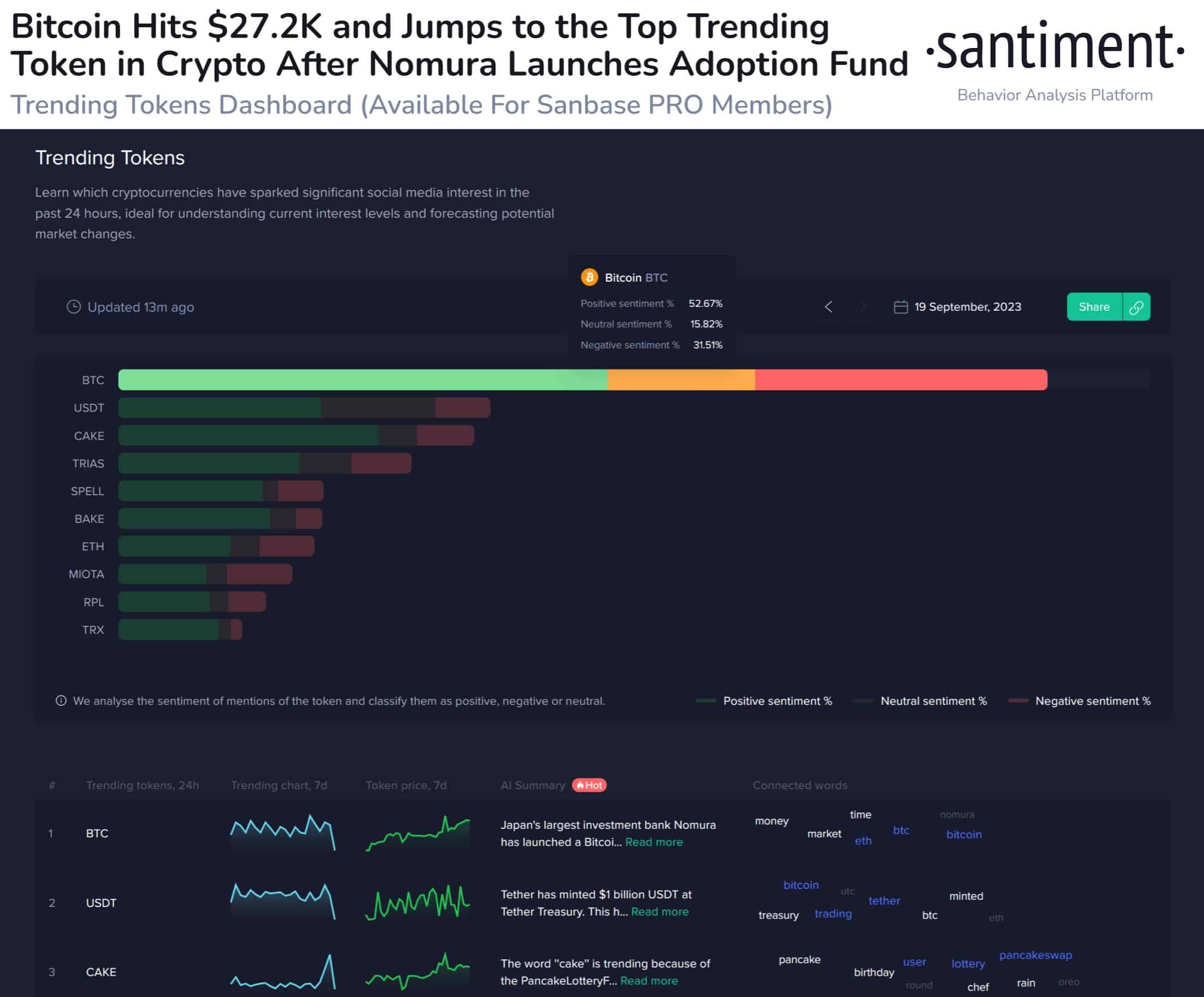

The world’s largest cryptocurrency Bitcoin (BTC) has registered a price surge once again gaining 1.44% and surging past $27,200 levels. This price pump follows hours after Japanese banking giant Nomura announced that its crypto subsidiary is launching a new adoption fund for institutional investors.

Bitcoin experienced a surge to $27.2K following the announcement of Japan’s largest investment bank, #Nomura, unveiling an Adoption Fund tailored for institutional investors. This development marks the latest stride in the #crypto space’s endeavors to broaden accessibility and engagement beyond the realm of conventional traders.

Courtesy: Santiment

Popular crypto analyst Michael van de Poppe stated that the BTC price is holding well above the support level of $ 26,700. He further added that the uptrend can continue further by establishing a new range.

#Bitcoin holds crucial level at $26,700-26,800 and rallies further.

This is strong and looks like we've got a continuation of the uptrend here.

New range established, new uptrend, new altcoins breaking out. pic.twitter.com/YzN5Fmdlp7

— Michael van de Poppe (@CryptoMichNL) September 19, 2023

Is This the Beginning of the Bitcoin Bull Run?

During a bull run, heightened on-chain activity typically takes center stage! This phenomenon becomes apparent when the monthly average of newly created wallets (depicted in red) surpasses the annual average (illustrated in blue). This occurrence signifies strong network fundamentals and a surge in Bitcoin utilization, noted popular crypto analyst Ali Martinez.

Courtesy: Ali Charts

It’s worth noting that despite stagnant prices, the on-chain activity for $BTC is expanding, hinting that the BTC bull run might be gearing up for a resurgence.

However, some market analysts believe that investors might get one final chance to fill their bags before the long-term bull run resumes. Popular crypto analyst Rekt Capital writes:

“Make no mistake – Bitcoin is in an early stage Bull Market Long-term the outlook is bullish Mid-term? Over the next 7 months, we may or may not get 1 last major correction Will it happen? It would be wise to at least be ready for it if it does”.

Rekt Capital also added that the BTC price could surge to $29,000 before one final downside movement.

#BTC

The Bearish Bitcoin Fractal assumes price could still rally to even as high as ~$29,000 before additional downside

Key Technical Events

• Overextension beyond Bull Market Support Band (yellow circle) possible but a failed retest of the Band as support post-breakout and… pic.twitter.com/dFgV1G5DAh

— Rekt Capital (@rektcapital) September 18, 2023

Cryptocurrency exchanges review:

#1

OKX - 24h Volume: $ 1 097 255 972.

OKX is an Hong Kong-based company founded in 2017 by Star Xu. Not available to users in the United States.

#2

ByBit - 24h Volume: $953 436 658.

It is headquartered in Singapore and has offices in Hong Kong and Taiwan. Bybit works in over 200 countries across the globe with the exception of the US.

#3

Gate.io - 24h Volume: $ 643 886 488.

The company was founded in 2013. Headquartered in South Korea. Gate.io is not available in the United States.

#4

MEXC - 24h Volume: $ 543 633 048.

MEXC was founded in 2018 and gained popularity in its hometown of Singapore. US residents have access to the MEXC exchange.

#5

KuCoin - 24h Volume: $ 513 654 331.

KuCoin operated by the Hong Kong company. Kucoin is not licensed to operate in the US.

#6

Huobi - 24h Volume: $ 358 727 945.

Huobi Global was founded in 2013 in Beijing. Headquartered in Singapore. Citizens cannot use Huobi in the US.

#7

Bitfinix - 24h Volume: $ 77 428 432.

Bitfinex is located in Taipei, T'ai-pei, Taiwan. Bitfinex is not currently available to U.S. citizens or residents.

My bitcoin-blog:

https://sites.google.com/view/solana-sol-potential-growth/ =)